cryptocurrency

Cryptocurrency

Investing in cryptocurrencies can potentially deliver substantial returns. According to CoinMarketCap figures, the price of bitcoin, for example, has gone from pennies during the first few years of its existence to more than $60,000 per unit at the time of this writing.< https://miamilotushouse.com/the-specifics-of-casino-hotels/ /p>

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

Brokerage services for Atomic Invest are provided by Atomic Brokerage LLC, a registered broker-dealer and member of FINRA and SIPC and an affiliate of Atomic Invest. Due to the relationship between Atomic Brokerage and Atomic Invest, there is a conflict of interest due to Atomic Invest directing orders to Atomic Brokerage. For additional information regarding conflicts, please see Items 5, 12 and 14 of Atomic Invest’s Form ADV Part 2A. For more details about Atomic Brokerage, please see the Form CRS, the Atomic Brokerage General Disclosures, and the Privacy Policy. Check the background of Atomic Brokerage on FINRA’s BrokerCheck. Fees such as regulatory fees, transaction fees, fund expenses, brokerage commissions and services fees may apply to your brokerage account.

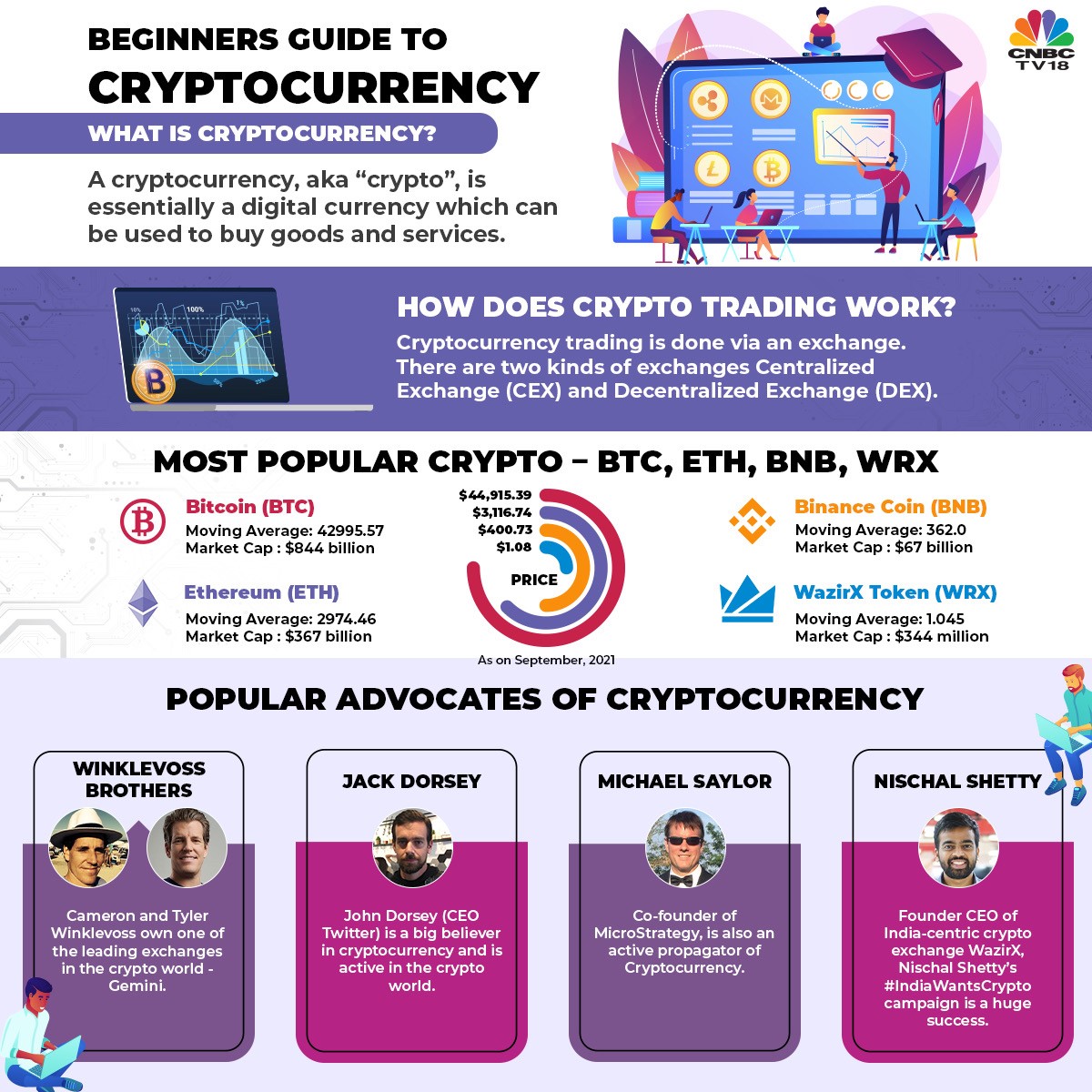

Cryptocurrency for beginners

Cryptocurrency markets move according to supply and demand. However, as they are decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. While there is still a lot of uncertainty surrounding cryptocurrencies, the below factors can have a significant impact on their prices:

Cryptocurrency markets move according to supply and demand. However, as they are decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. While there is still a lot of uncertainty surrounding cryptocurrencies, the below factors can have a significant impact on their prices:

Yes, you can day trade cryptos. The volatile nature of crypto markets means that significant and rapid price movements can occur daily. Whereas this volatility increases your exposure to risk, it also presents opportunity. Our tight spreads and high liquidity mean that you can enter and exit positions quickly when trading with CFDs.

Veel mensen bouwen crypto vermogen op door te sparen. De theorie is eenvoudig: je koopt crypto en laat deze voor lange tijd staan. In de loop der jaren stijgt de koers en voilá, je vermogen is gestegen in waarde. Deze methode heet ook wel HODL: Hold On for Dear Life. Het uiteindelijke rendement hangt af van de munt, maar vaak kan dit meer zijn dan het rendement van een bank. De keerzijde hiervan is wel dat de koersen ook kunnen dalen, waardoor je uiteindelijk verlies lijdt.

Eén ding is zeker: Je weet nooit van tevoren welke cryptocurrency in waarde gaat stijgen. Er komt altijd een portie geluk bij kijken. Wel kun je de mate van geluk beperken door grondig onderzoek te doen. Effectief beginnen met cryptocurrency vergt dus leergierigheid. Het werkt namelijk in jouw voordeel wanneer je zoveel mogelijk over cryptomunten leert.

Cryptocurrencies are notoriously volatile. For traders using leveraged derivatives that allow for both long and short positions, large and sudden price movements present opportunities for profit. However, at the same time, these also increase your exposure to risk. In short, the more volatile the market, the more risk you carry when trading it.

Cryptocurrency tax

Depending on your income each year, long-term capital gains rates can be as low as 0%. For 2024, you can also avoid paying taxes when selling your cryptocurrency if your table income is less than or equal to $47,025 if you file as Single, as Married Filing Separately, or your taxable income is less than or equal to $94,050 if you file as Married Filing Jointly.

Many businesses now accept Bitcoin and other cryptocurrency as payment. If someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they’d paid you via cash, check, credit card, or digital wallet. For tax reporting, the dollar value that you receive for goods or services is equal to the fair market value of the cryptocurrency on the day and time you received it.

When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. How the IRS treats these two classes is very different in terms of the tax consequences you’ll encounter.

Notably, if a taxpayer answers No to the virtual currency question or doesn’t include a Form 8949 and is issued a Form 1099 from an exchange, that taxpayer is more likely to be audited; the IRS now has information that may result in penalties on top of whatever additional tax may be owed. Honest answers are always recommended.

Trading cryptocurrency

Cryptocurrency has been around for over ten years and has seen a general spike in value – to the delight of investors. The record of ownership of cryptocurrency is stored on a blockchain, where transactions between users’ digital crypto wallets are added.

High-frequency trading (HFT) is an advanced trading strategy that uses algorithms and bots to automatically enter and exit trades. HFT encompasses computer science, complex market concepts and mathematics and is not suitable for individual beginner investors.

When you seek out a crypto trading strategy, you might try automated crypto trading. Trading bots enact a strategy that is intended to give you the best results given your investment goals. Because automated trading can provide you with a conservative, neutral, or aggressive method, you can make money quickly, hold your coins, or diversify your portfolio.

Yes, you can day trade cryptos. The volatile nature of crypto markets means that significant and rapid price movements can occur daily. Whereas this volatility increases your exposure to risk, it also presents opportunity. Our tight spreads and high liquidity mean that you can enter and exit positions quickly when trading with CFDs.

Cryptocurrency markets are decentralised, which means they are not issued or backed by a central authority such as a government. Instead, they run across a network of computers. However, cryptocurrencies can be bought and sold via exchanges and stored in ‘wallets’ .